TL;DR

- Ethereum rebounds from $4,500 support, with one analyst mapping four scenarios, including a possible run to $5,000.

- U.S. spot Ethereum ETFs record $3.71B inflows in eight days, led by $519.7M into BlackRock’s fund.

- Exchange reserves drop to 18.5M ETH, the lowest in three years, pointing to a tighter available market supply.

Price Action and Key Levels

Ethereum (ETH) is trading near $4,650 after a recent recovery from the $4,500 support area. The move comes with a 2% decline in the past 24 hours but a 19% gain over the past week. Trading volume in the last 24 hours stands at $68.25 billion.

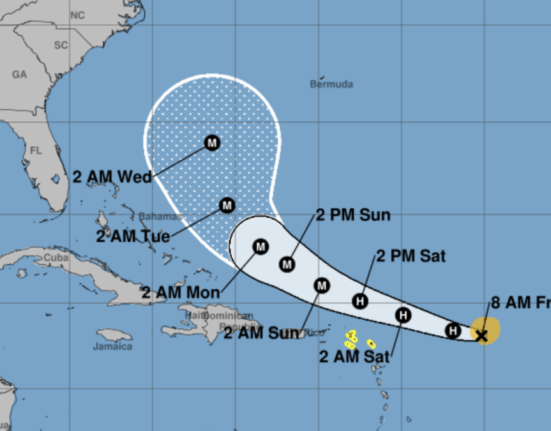

Analyst Lennaert Snyder notes four possible price paths. The immediate resistance sits around $4,780, which he calls the range high.

Notably, a breakout above this level could open the way toward the $5,000 target shown in his chart. The immediate support is $4,490, and a deeper pullback could test a lower zone between $4,320 and $4,380.

$ETH bounced from $4,490 support as charted yesterday.

4 scenario’s for Ethereum now:

– Gain $4,780 rangehigh.

– Reject $4,780 rangehigh.

– Test $4,490 rangelow again.

– Test lower support.If price tests lower support I’m longing it. But I prefer sending from here. pic.twitter.com/x43vhBtnRk

— Lennaert Snyder (@LennaertSnyder) August 15, 2025

If ETH breaks and holds above $4,780, it could extend gains toward $5,000. A rejection at $4,780 may bring the price back to $4,490. A retest of $4,490 that holds could trigger another push toward the range high.

A break below $4,490 would shift focus to the lower support zone, where Snyder suggests possible long entries.

Meanwhile, the current structure remains range-bound between $4,490 and $4,780. Short-term movement will depend on whether ETH can reclaim the upper boundary or drop back toward support levels.

ETF Inflows and Institutional Activity

Spot Ethereum exchange-traded funds in the U.S. recorded $639.6 million in net inflows on Thursday, marking eight consecutive days of inflows. BlackRock’s ETHA led with $519.7 million, followed by $60.7 million into the Grayscale Ethereum Mini Trust and $56.9 million into Fidelity’s FETH. Invesco’s ETF also saw modest inflows.

That comes after a record inflow of 1.02 billion on Monday. After eight consecutive days, the cumulative inflows totaled $3.71 billion. Large-scale purchases have also been reported, with one whale buying $138.46 million in ETH recently, adding to $242.34 million acquired over the past two days.

Exchange Reserves at Multi-Year Lows

Ethereum reserves on centralized exchanges have fallen to 18.5 million ETH, the lowest in over three years. The decline has accelerated in recent weeks as more tokens are moved off trading platforms.

As reserves drop, ETH’s price remains near $4,600. Such outflows often point to coins moving into long-term holding or staking, reducing the liquid supply available for immediate trading.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!