American Bitcoin, a bitcoin mining company backed by President Donald Trump’s sons, is going public in a new merger deal with Gryphon Digital Mining. Investors and political observers are taking notice as it presents a mixture of Bitcoin, Wall Street and the Trump brand.

This reverse merger allows for American Bitcoin Corporation to become a publicly traded company. This will happen through a stock-for-stock merger with Gryphon Digital Mining, a small-cap bitcoin miner already listed on the Nasdaq.

Once the deal is done, the new company will be called American Bitcoin and will trade on the Nasdaq under the ticker symbol ABTC. The merger is expected to close in the 3rd quarter of 2025.

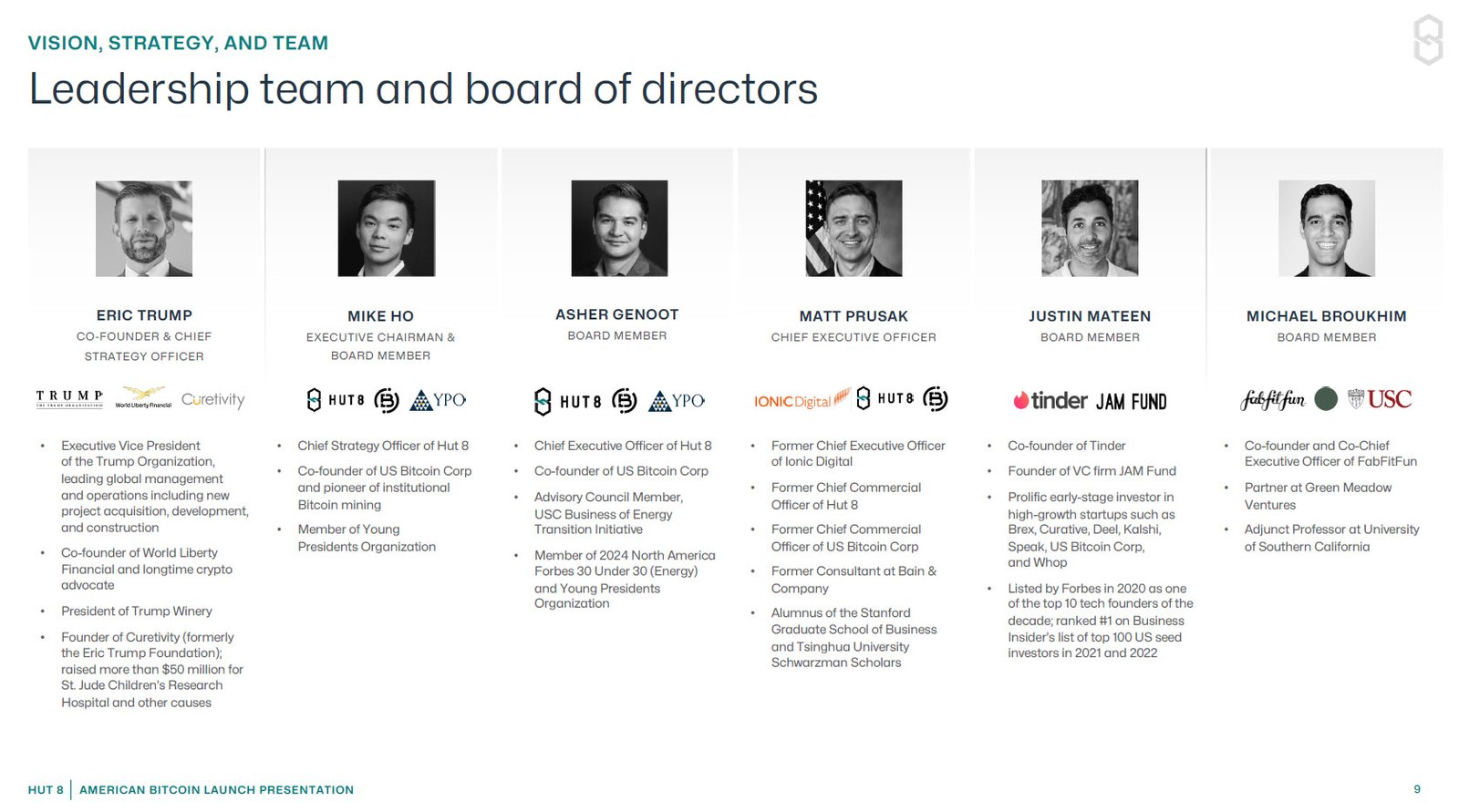

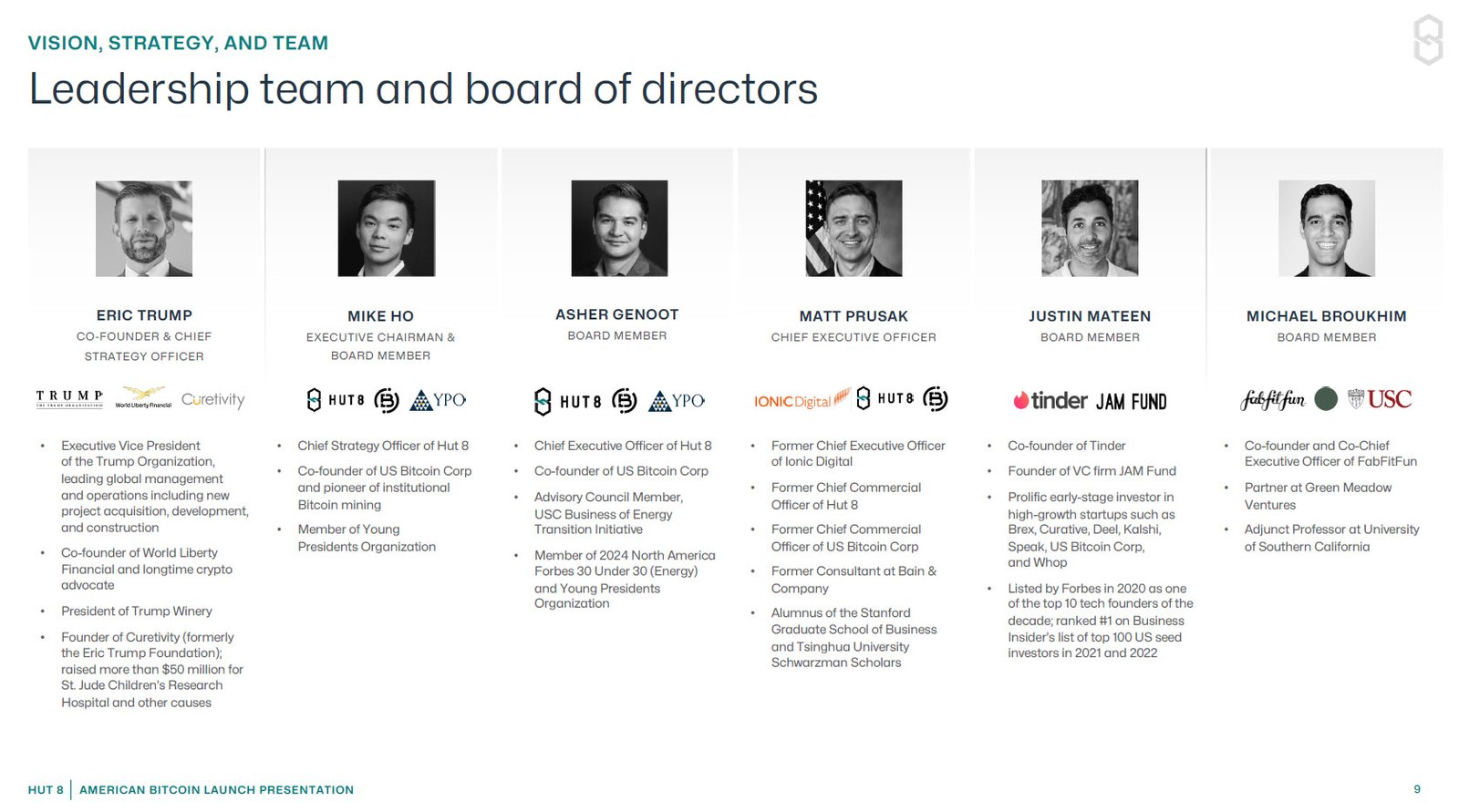

Eric Trump, who will be the Co-Founder and the Chief Strategy Officer, said:

“Our vision for American Bitcoin is to create the most investable Bitcoin accumulation platform in the market.”

The Trump family’s involvement has gotten a lot of attention. Eric Trump and Donald Trump Jr. launched American Bitcoin in March this year with digital asset infrastructure company Hut 8, which owns 80% of American Bitcoin.

After the merger, American Bitcoin shareholders — including the Trump brothers and Hut 8 — will own about 98% of the new company. Gryphon shareholders will own 2% even though Gryphon is the public company facilitating the merger.

Instead of an IPO (Initial Public Offering), American Bitcoin is going public through what’s called a reverse merger. This means it will take over Gryphon’s public listing.

This is often faster and simpler than a traditional IPO. It allows American Bitcoin to access public capital markets while maintaining operational and strategic control.

Hut 8 CEO Asher Genoot said the merger is a big step forward for the company. “By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet,” Genoot said.

The announcement sent Gryphon’s stock soaring. Shares rose over 280% and Hut 8’s stock went up over 11%. Clearly investors are interested in bitcoin-focused public companies when the asset itself is close to its previous all-time high.

But not everyone is buying. Some investors and analysts are questioning what Gryphon is actually bringing to the table. Gryphon won’t have a seat on the board or any representation in the new management team. Their role seems to be just to provide the public listing.

Many questions remain unanswered because there are no details on mining operations and what Gryphon’s role is beyond the merger.

American Bitcoin’s goal goes far beyond just mining bitcoin. It wants to become a national bitcoin reserve builder and a major player in that space by storing large amounts of bitcoin as a strategic asset.

The company plans to take “capital-light” advantage of Hut 8’s existing infrastructure, so there won’t be any need to build massive new data centers. Hut 8 already manages over 1,000 megawatts of energy capacity, and apparently, they will handle all the mining operations.

This is happening at a tough time for the mining industry in the U.S. and globally.

Profit margins are shrinking, and companies are really feeling the pinch of high operational costs. Hut 8 just reported a 58% drop in revenue and a $134 million net loss for the first quarter of 2025.