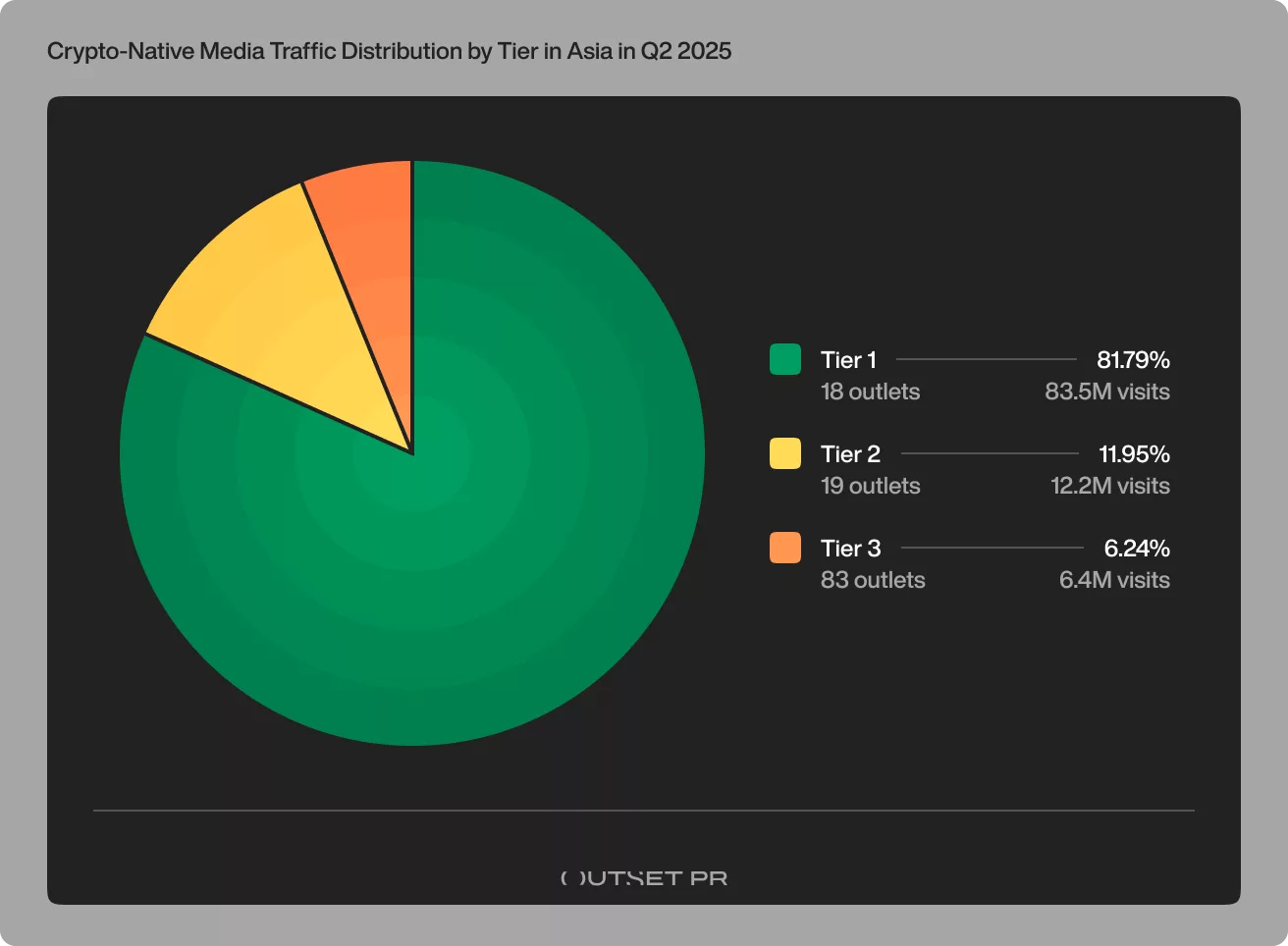

Asia’s crypto audience has made a decisive shift: they’re no longer relying on algorithms to tell them what matters. In the second quarter of 2025, 82% of all crypto-native traffic in the region flowed into tier-1 publishers, according to new findings from Outset Data Pulse, a continuous intelligence framework developed to track visibility, engagement, and trust across the global crypto media ecosystem.

Behind that dominance lies an even stronger signal: 54% of all visits were direct, meaning readers went straight to outlets they already know and trust.

At Outset PR, we found evidence to support a market consolidating around trusted brands, with loyal readers typing in, bookmarking, and returning often, a reversal of what we previously observed in LATAM, where the region’s top-tier collapsed from six outlets to just one in Q2.

“Asia’s crypto readership has entered a phase of maturity,” said Maximilian Fondé, Outset PR’s senior analyst. “We’re watching a region where trust, habit, and structure work together. Readers are curating information for themselves. Every direct visit reflects intent, not chance, and that intent is what’s now shaping the visibility map of crypto media.”

Built on PR-native formulas and indices, including the engagement index and refined composite score, Outset Data Pulse benchmarks how crypto media ecosystems evolve across regions and outlet tiers. Its goal is to show where narratives compound, not just where they appear.

For this quarter’s Asia crypto media traffic analysis, we examined Similarweb data from 171 crypto-native and mainstream outlets across East and Southeast Asia, excluding those with under 10,000 monthly visits for comparability.

Unlike traditional adoption metrics, the framework doesn’t measure on-chain growth directly, but it tracks media behavior around adoption. In other words, it captures how visibility, credibility, and reader trust move together long before adoption trends show up on-chain.

Before diving into the charts and traffic maps, here’s a quick snapshot of what this report unpacks. We’ve summarized the core findings below, but the full context, country breakdowns, and narrative analysis follow right after.

What makes Asia’s crypto readers different from Western audiences?

Asia’s crypto readers have built habits around intentional discovery. Over 54% of visits are direct, meaning readers already know where they’re going before they click. Instead of relying on social feeds or aggregators, they type URLs, open apps, or bookmark their preferred outlets, especially in Japan, Korea, and Indonesia, where speed, accuracy, and native-language context define trust.

How are the biggest crypto news sites in Asia getting all the attention?

A concentrated group of 18 tier-1 publishers now commands 82% of all crypto-native traffic across East and Southeast Asia. These outlets have become the region’s information anchors that set the tone, agenda, and even SEO signals for everyone else. Their dominance reflects reach, reader loyalty, and structural credibility.

Why do trusted crypto outlets in Asia rank better in search?

The region’s most trusted crypto outlets convert loyalty into measurable visibility. Every direct visit, return session, and citation teaches algorithms which sources to prioritize. This creates a compounding cycle: trusted publishers rank higher, are cited more often, and attract even more direct traffic. It’s how Asia’s crypto media has turned audience behavior into a structural advantage. It has become a trust economy that scales across both human and AI discovery systems.

In the second quarter of 2025, crypto-native outlets across the region drew over 102 million visits, a stability that contrasts sharply with Eastern Europe, where 63% of crypto publishers lost traffic in the same quarter.

Month by month, the picture was clear: growth in May (+2.2%), a brief pause in June (-1.3%), and a total that remained well above pre-2024 averages. Rather than a boom-and-bust cycle, the data shows a readership that’s settled into habit — loyal, predictable, and self-selecting.

Our analysis found that about 43% of publishers gained audience share, suggesting a quiet reshaping of the landscape as smaller or less trusted outlets faded. Mainstream finance platforms, meanwhile, saw sharper losses and fewer than one in five outlets managed to grow.

Crypto readers in Asia are skipping Google and going straight to their favorite sites

Search is no longer the main gateway to crypto news in Asia simply because readers already know where they’re going.

Direct visits now make up the majority of all crypto-native traffic, surpassing both search and social combined. Organic search still drives roughly a third of visits, but its share is shrinking as audiences build habits around familiar, trusted outlets.

The pattern is especially strong in markets like Korea, Japan, and Indonesia, where readers favor speed, clarity, and native-language reporting over algorithmic discovery.

Instead of depending on Google or social feeds, readers are typing URLs, using apps, or bookmarking trusted publishers they return to daily. The reasons are simple: speed, context, and language accuracy. In a region where local markets shift by the hour, waiting for global coverage isn’t an option.

Which crypto outlets get most of the traffic in Asia right now?

Asia’s crypto media market has clearly consolidated around a small circle of dominant players. A tier-1 group of 18 publishers now commands nearly 82% of all crypto-native traffic, roughly 83.5 million visits in total.

This consolidation reflects more than just reach; it’s a signal of reader loyalty and structural credibility. Tier-1 sites are now operating like sources that set the tone and agenda for everyone else. Meanwhile, tier-2 outlets (19 in total) drew about 12.2 million visits, and a long tail of 83 niche sites generated another 6.3 million, sustaining local coverage on AI tokens, DeFi, and regulatory updates.

Together, they form a two-speed ecosystem: large, trusted newsrooms anchoring visibility, and smaller, agile publishers shaping new narratives.

Countries that dominate Asia’s crypto news traffic in 2025

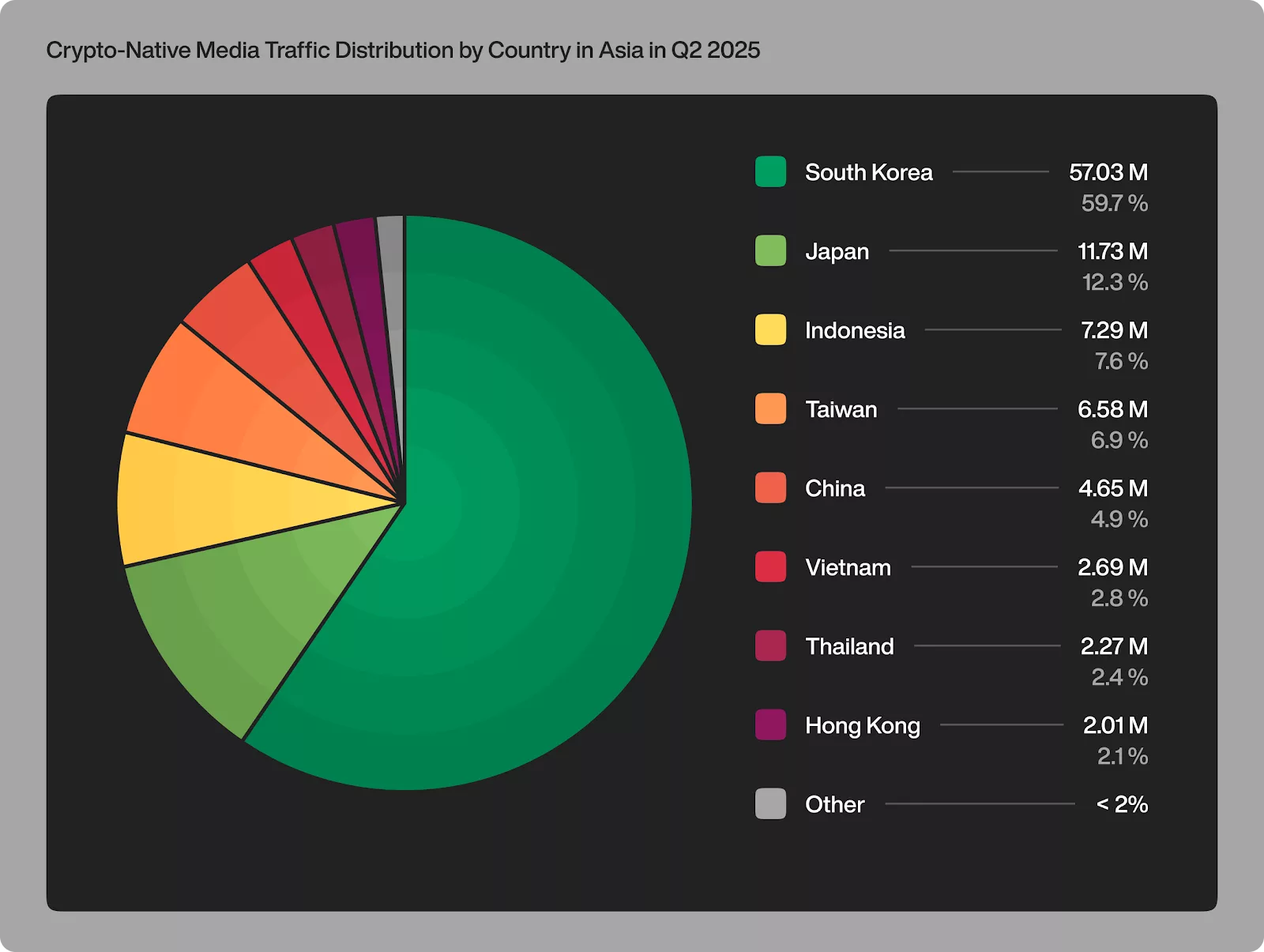

South Korea and Japan together account for nearly three-quarters of all crypto-native visits, pulling in 57.03 million and 11.73 million, respectively. Both countries have mature exchanges, active retail participation, and long-standing crypto news ecosystems that readers visit daily.

Behind them, Indonesia, Taiwan, and China form the region’s second tier, being the fast-growing hubs that balance domestic audiences with bilingual coverage. Vietnam and Thailand continue to climb through social and influencer-led ecosystems, while Hong Kong, Malaysia, Singapore, and the Philippines sustain smaller but loyal reader communities.

What emerges is a layered landscape: the Korea–Japan axis sets the pace, while Southeast Asia builds momentum through localization and accessibility.

Most popular social platforms for crypto news in Asia

Social platforms may only account for around 5% of crypto-native traffic, but they continue to drive a disproportionate share of engagement and discussion. X dominates the space, drawing roughly half of all social traffic, while YouTube follows with over one-fifth, thanks to its strong long-form and educational content. Facebook remains a reliable community hub, especially in Vietnam and Thailand, where local crypto groups still set the tone for discussion.

Smaller but steady traction comes from LinkedIn, Telegram, and Reddit, each serving different audience segments: from professionals to token communities. Instagram, Discord, and Weibo round out the list, showing that even visual and niche platforms play a part in regional engagement.

Across the region, X acts as Asia’s real-time crypto newsroom, YouTube fuels education, and Facebook sustains grassroots dialogue. Together, they form the social backbone of Asia’s crypto media ecosystem that is small in size, but high in influence.

What crypto storylines are driving the most engagement in 2025?

Across Asia, the storylines driving the most traffic are about scale and structure. AI-integrated blockchains, real-world asset (RWA) tokenization, and regulatory breakthroughs in Japan and Korea continue to dominate reader attention, alongside community-led coverage in Southeast Asia.

These are the stories that keep Asia’s crypto mainstream growing even as global interest cools. While Western outlets chase headlines about ETF flows and regulatory clashes, Asian publishers focus on how these developments play out locally — from exchange policies to trading habits and domestic innovation.

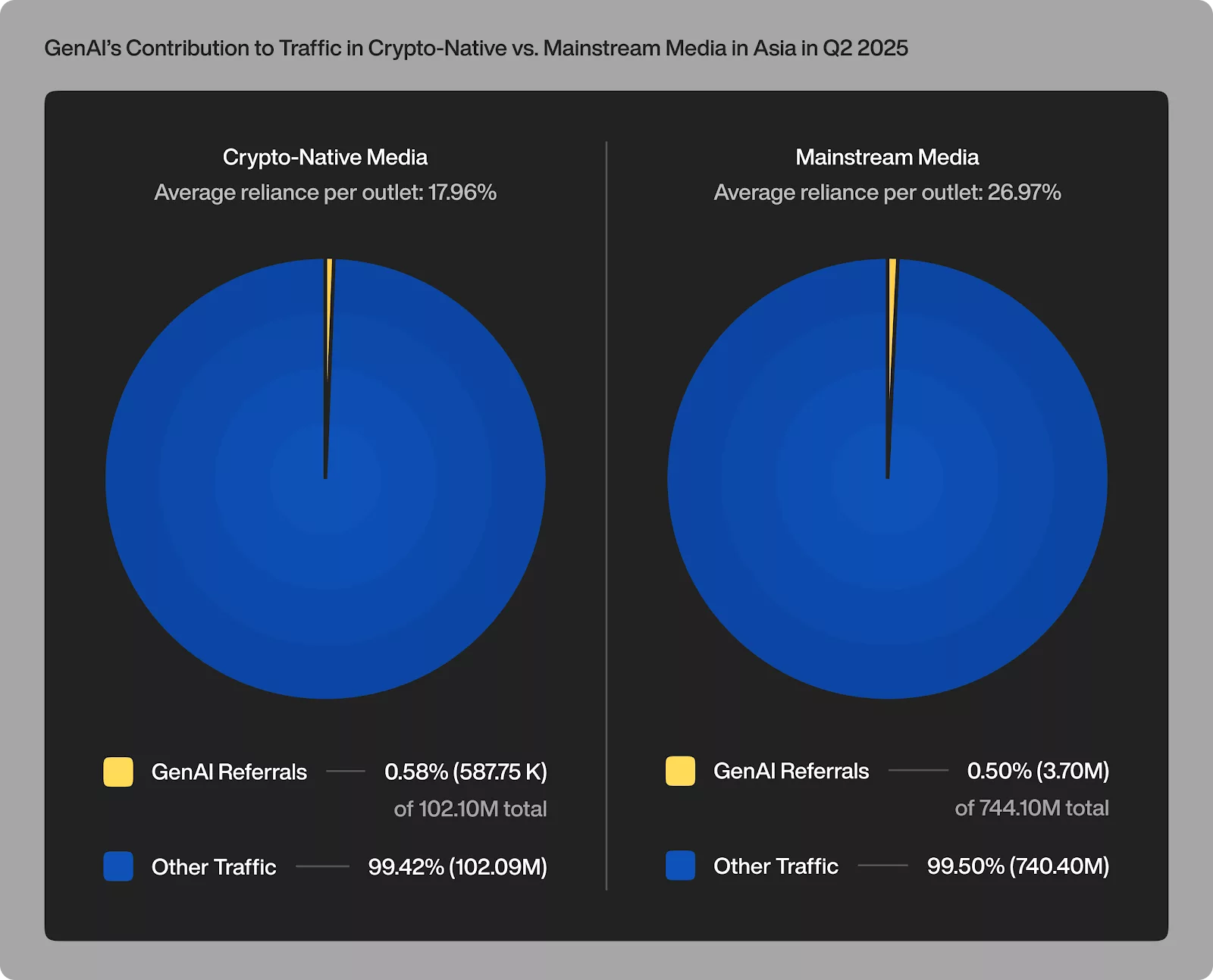

Even AI discovery is starting to reflect that shift. In Q2 2025, AI referrals accounted for roughly 0.6% of total crypto-native traffic, or nearly 18% of referral traffic overall, proving that well-structured, trusted content now travels through both people and models.

In short, Asia’s crypto narratives aren’t just being read; they’re being re-used, cited, and surfaced, which comes as a sign that the region’s media layer is quietly defining what global crypto coverage looks like next.

For Outset PR, Asia’s crypto media is a preview of what sustainable visibility looks like worldwide. The data points to one clear rule: trust scales faster than traffic. The outlets leading across Japan, Korea, and Southeast Asia aren’t chasing algorithms; they’re shaping them, with clean structure, consistent publishing, and language that resonates locally.

Crypto brands and publishers can take the same approach and turn discovery into routine, write for humans but format for machines, and treat every returning visitor as a long-term asset, not a conversion.

“Treat direct as your north star and structure as your engine,” Fondé summarizes his take. “Outset Data Pulse translates media behavior into signals teams can act on. We don’t replace on-chain or market data; we make it actionable.”