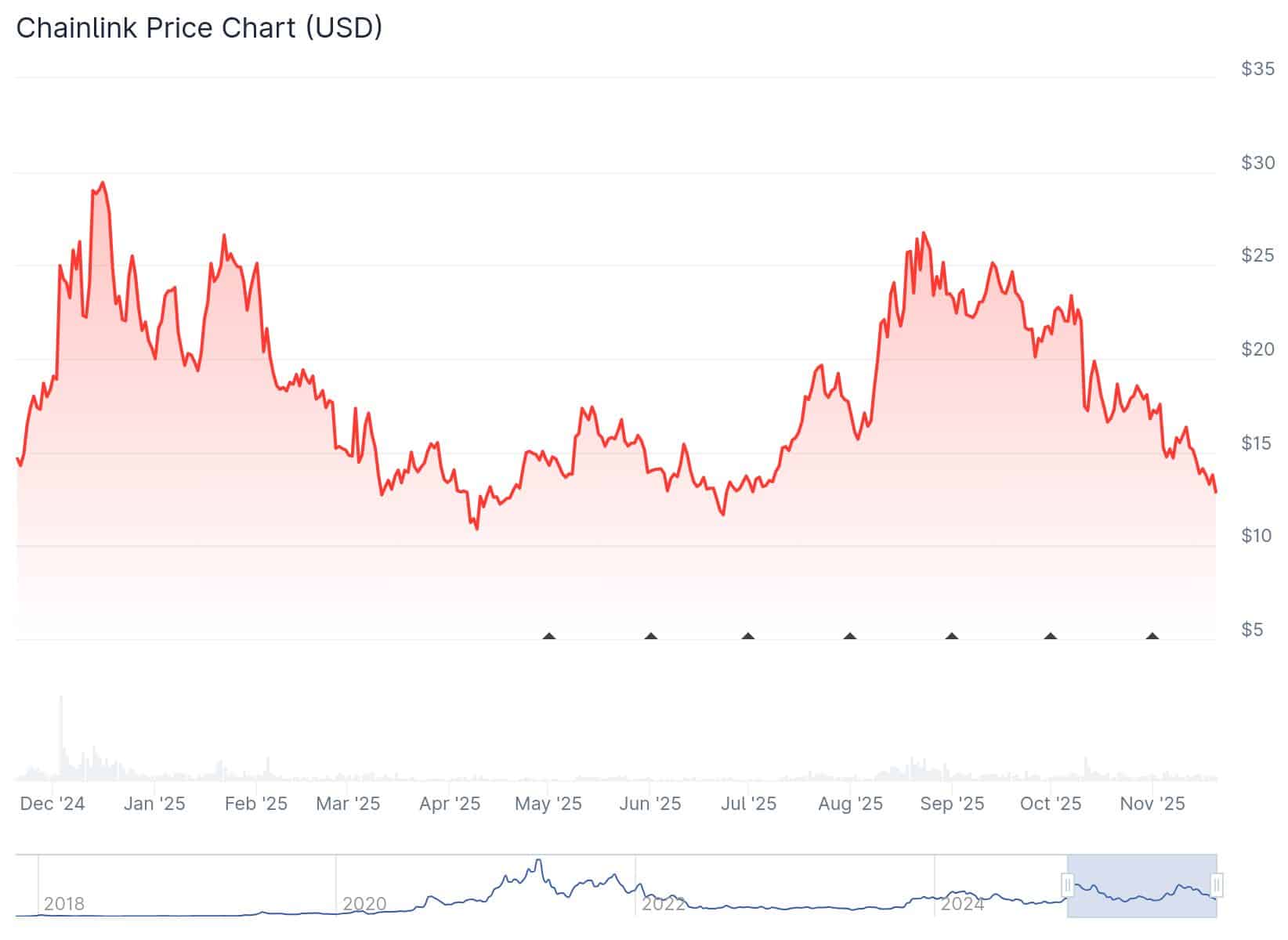

Chainlink’s LINK token has slipped back into a consolidation phase after a volatile summer.

The fast climb from $11 to $28 didn’t hold, and the price later dropped to around $14 in early November.

Analysts say the pullback reflects broader uncertainty in the market, as traders wait for clearer signals on interest rates and monetary policy.

Despite the correction, Chainlink remains central to the blockchain ecosystem. It is still the main network that connects smart contracts to real-world data, a role that most DeFi platforms rely on.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

How Could CCIP Change Cross-Chain Communication for DeFi?

The oracle system now supports hundreds of DeFi protocols and delivers price feeds that help secure billions of dollars locked across the sector.

The next big step for the project is the Cross-Chain Interoperability Protocol, or CCIP. It’s designed to let apps on different blockchains share data and messages in a secure way.

Unstable Coin has upgraded to the Chainlink interoperability standard & made USDUC a Cross-Chain Token (CCT) to enable seamless token transfers across HyperEVM & Solana via CCIP.@usduc_official also integrated Chainlink Data Streams to deliver highly secure, sub-second data to… pic.twitter.com/LEWLmsWzQl

— Chainlink (@chainlink) November 19, 2025

That’s a major issue in a market where most networks still work on their own.

Some large financial institutions are studying CCIP for their own systems. If that interest continues to build, it may push demand for LINK higher, since nodes use the token as collateral inside the network.

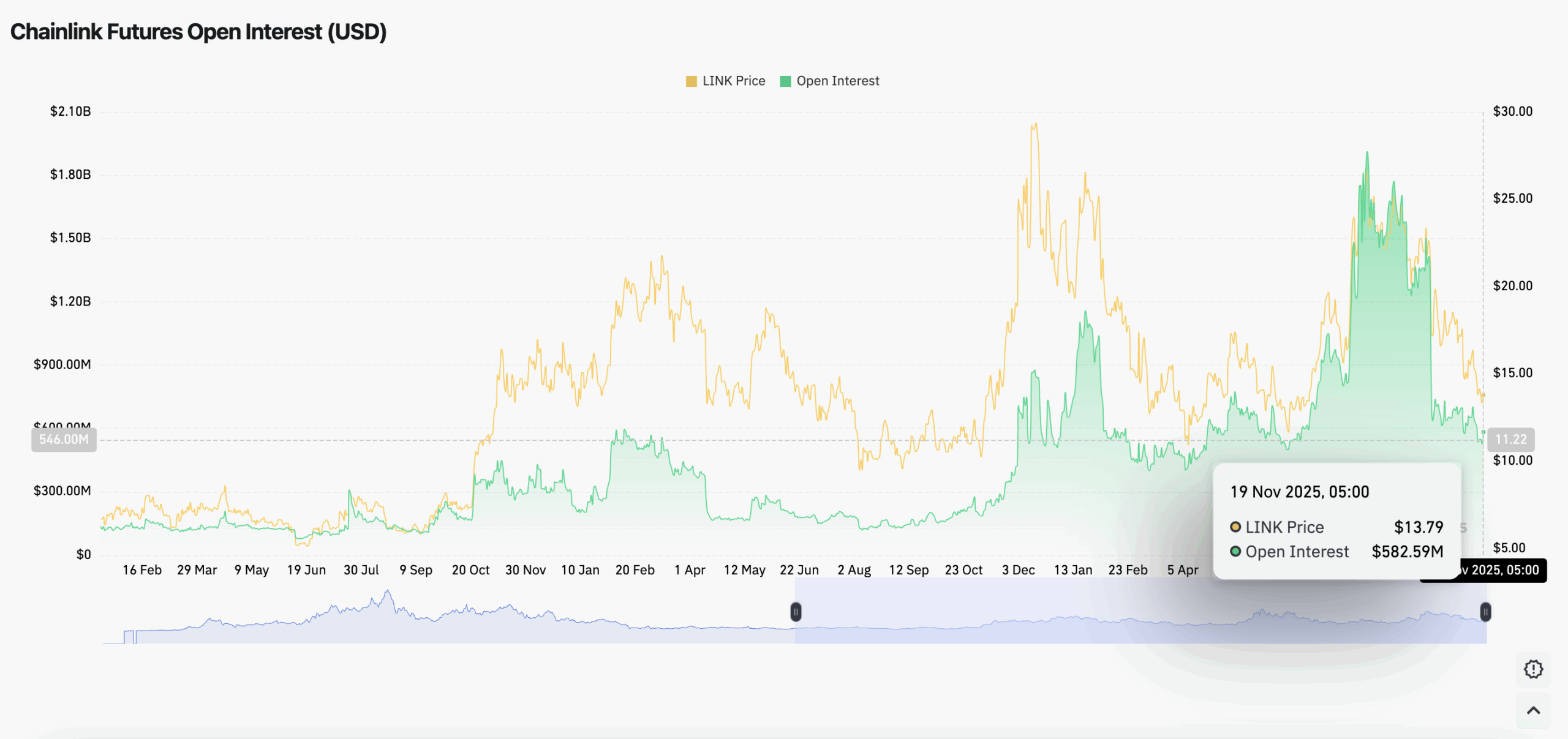

Data from Coinglass shows futures open interest sitting near $582.59M, with about $1.1Bn in futures trading volume over the past 24 hours on major exchanges.

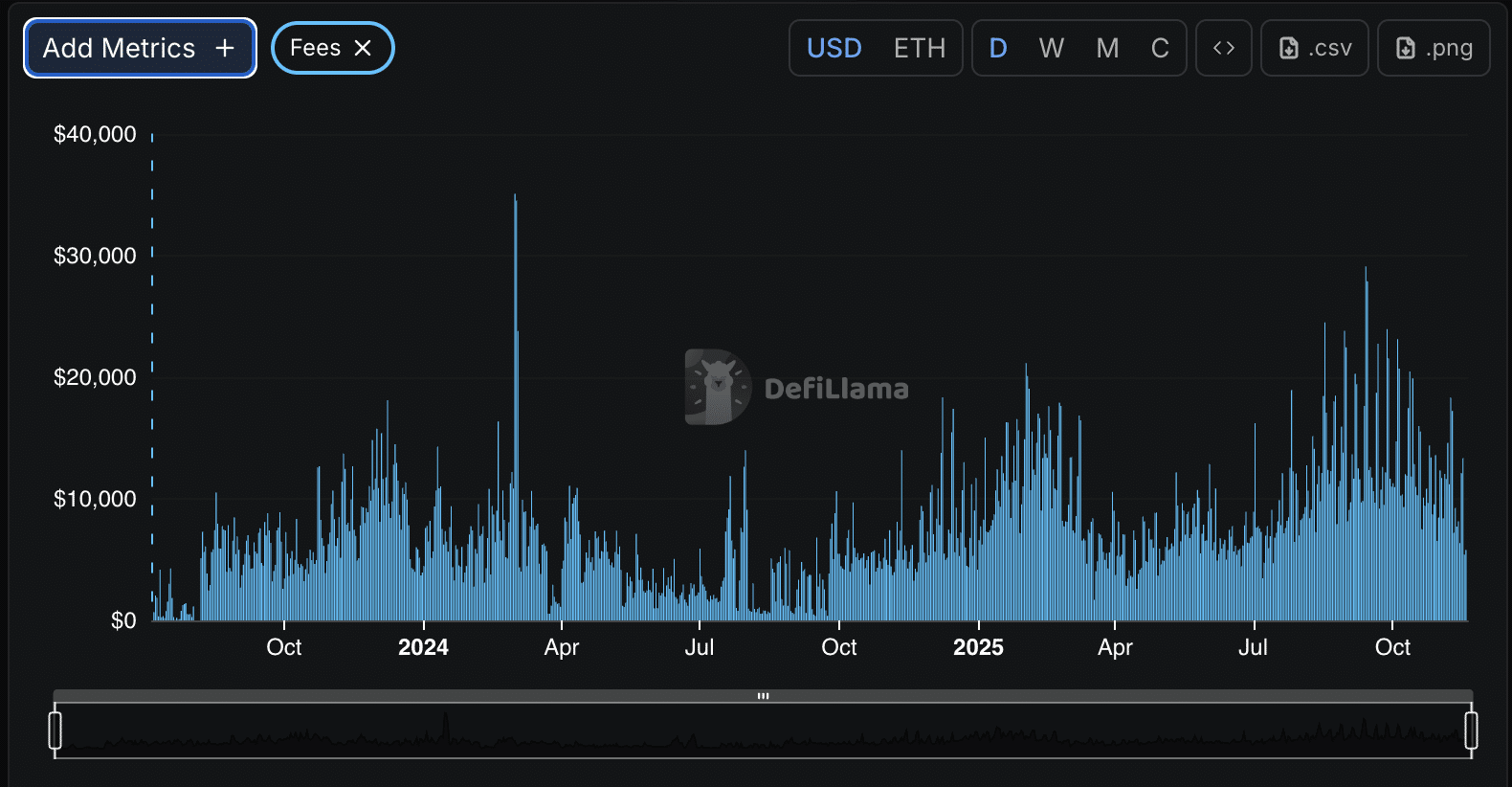

DefiLlama’s latest figures list Chainlink oracles securing roughly $48.5 billion in Total Value Secured, a sign that the network still plays a central role across DeFi.

Chainlink remains central to DeFi lending, derivatives, and most major on-chain markets. Its perpetuals dashboard shows about $45Bn in 24-hour decentralized perpetual volume.

DISCOVER: 9+ Best Memecoin to Buy in 2025

LINK Price Prediction: Is Chainlink Losing Bearish Momentum as It Approaches Oversold Levels?

Some of that flow depends on Chainlink’s price feeds, though the reports don’t break down how much comes from specific assets like LINK.

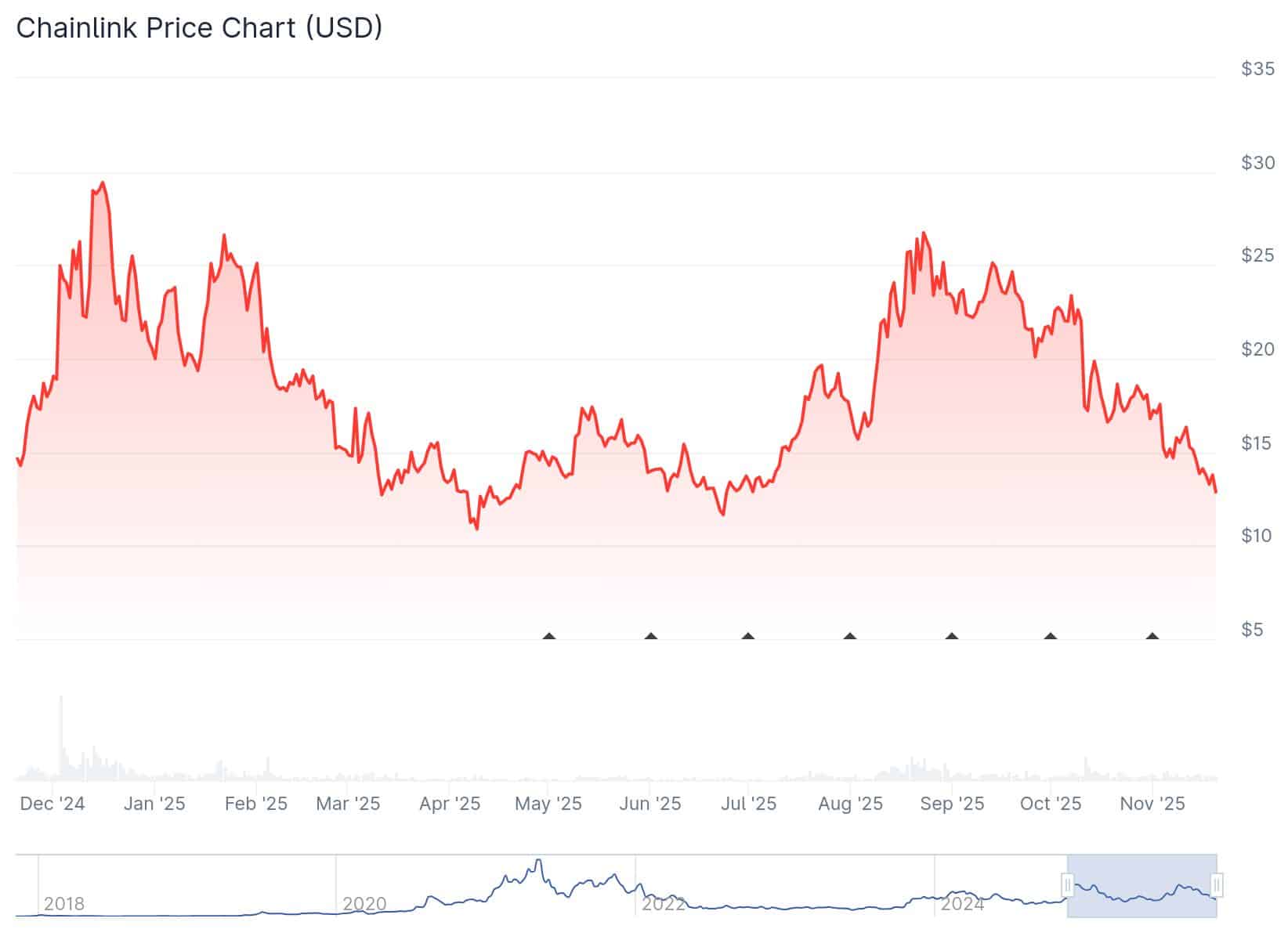

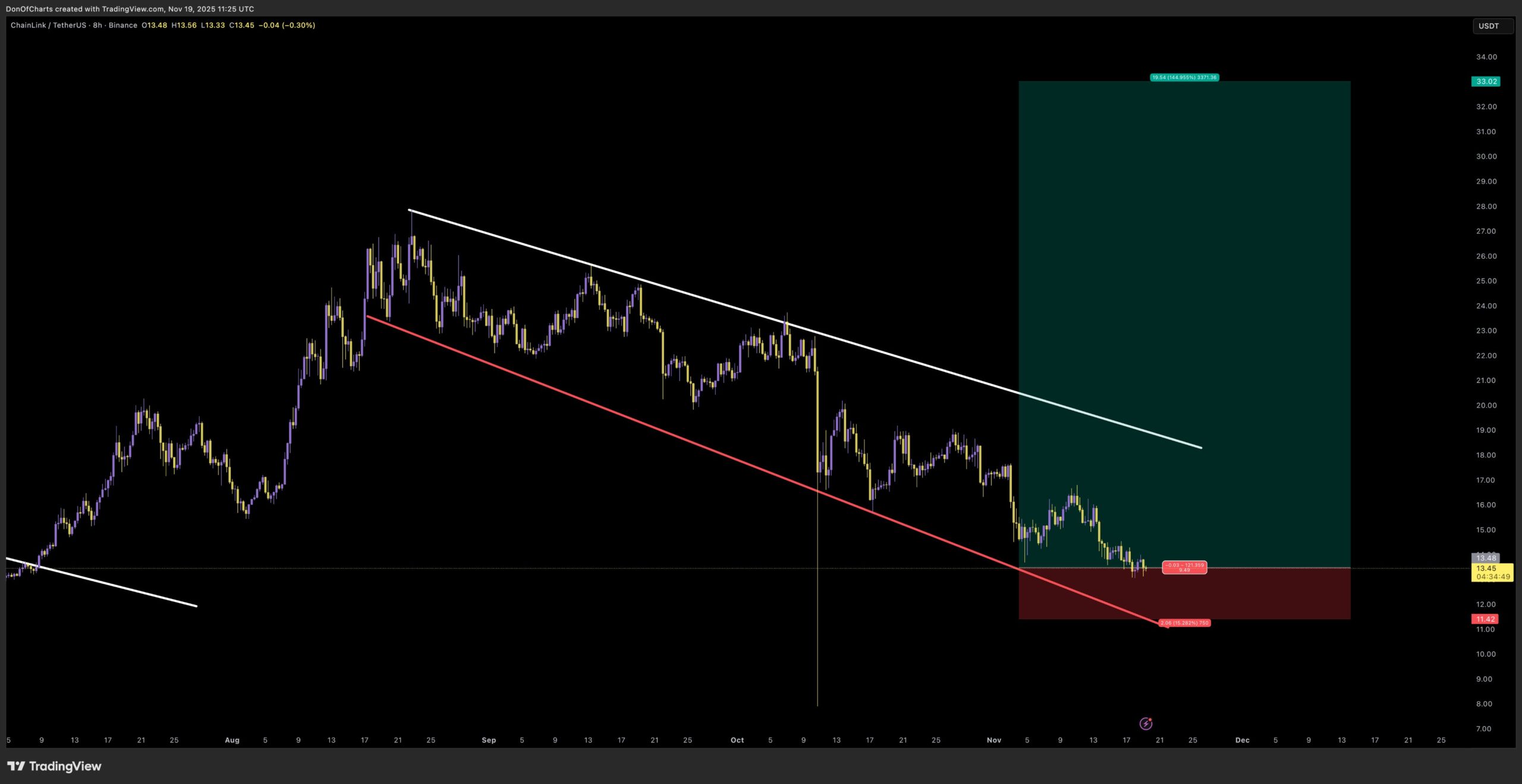

Don, a crypto analyst, posted the chart on X, which shows LINK is still moving inside a long-running descending channel. The price has reacted to both sides of this pattern for months.

The upper trendline has stopped every attempt to push higher, while the lower red line continues to act as support.

Recent trading places LINK near the bottom of the channel, which signals that sellers remain in control for now.

LINK has slipped back toward the $12–$13 area, a zone that has acted as support since September.

The price tapped this region again but didn’t fall through it, suggesting sellers are losing momentum as the token moves deeper into oversold conditions.

Even so, the broader trend stays bearish. The chart still shows a pattern of lower highs and lower lows, keeping LINK inside a downward channel.

The analyst notes that a long setup only becomes valid if LINK climbs back above the mid-range and breaks out of the channel.

The stop-loss sits just below the trendline near $11.40. The main target is in the $30–$33 band. Reaching that zone would mark a clean breakout and signal a shift in sentiment.

The token is still trading under the white resistance line that has rejected every bounce since mid-August. Without a breakout, the market has little evidence of renewed strength.

For now, LINK remains in a steady downward pattern, and traders are watching the $12 area closely. If this level fails, the chart leaves room for further losses.

EXPLORE: DEXTools vs. DEX Screener: Which One is Better in 2025

The post LINK Price Prediction: Is Chainlink Close to a Trend Reversal After Months of Lower Highs? appeared first on 99Bitcoins.