A high-stakes confrontation is unfolding between World Liberty Financial (WLF) and its largest investor, Justin Sun, after the project blacklisted a wallet containing billions of its WLFI tokens.

The move, which effectively froze an estimated $100 million in assets, follows intense market speculation that Sun was responsible for a significant sell-off, contributing to a dramatic price collapse for the token.

Blacklist Sparks Governance Crisis

On September 5, blockchain analytics account Spot on Chain revealed that WLF’s controlling address invoked the blacklist function on the WLFI contract, targeting wallet 0x5AB2…DA74. The address had bought three billion WLFI during the project’s initial coin offering (ICO), unlocked 600 million, and recently moved 54 million tokens, worth around $11 million, to fresh wallets.

By blacklisting the address, WLF froze the remaining tokens indefinitely. Commentators quickly pounced on the development. “WLFI just proved DeFi isn’t ‘decentralized’ at all … it can be blacklisted, frozen, shut down,” wrote analyst Shanaka Anslem Pereira, comparing the maneuver to IMF-style controls.

Justin Sun, who invested $75 million into WLF in 2024, hit back on X, blasting the freeze as unjust. “My tokens were unreasonably frozen,” he wrote, stressing that “tokens are sacred and inviolable—this should be the most basic value of any blockchain.”

Sun went further, warning that WLF’s actions “not only violate the legitimate rights of investors, but also risk damaging broader confidence in World Liberty Financials.”

Price Fallout and Market Outlook

At the time of this writing, WLFI was trading at $0.1815, down 1.6% on the day after dipping as much as 4.2% in the past hour. The token has collapsed nearly 40% from last week’s high of $0.3087 and is now down 45% from its September 1 peak of $0.3313.

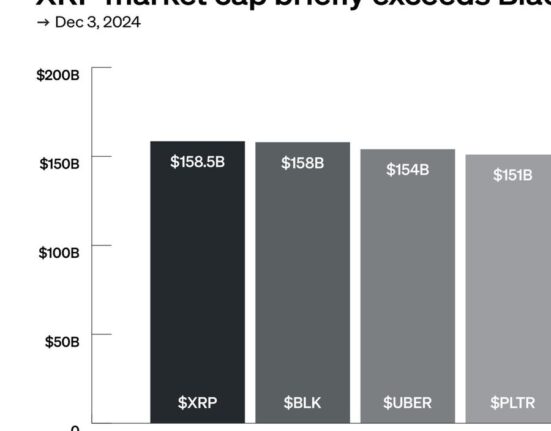

Yesterday, selling pressure drove WLFI to a record low of $0.164 before it rebounded slightly. For now, trading remains frenzied, with more than $1.3 billion in daily turnover, while the project’s market cap stands near $4.9 billion, which still puts it within the global top 40.

The standoff between Sun and the WLF team is now the defining test for the project. If the blacklist remains, observers say it risks cementing perceptions that WLF’s governance is centralized and arbitrary.

However, even if it were to be reversed, the blacklist could already have harmed WLF’s credibility, which, a while back, saw the Trump family quietly trim its ownership from 60% to 40%. In either case, WLF’s promise of a “decentralized” financial system is facing its most significant challenge yet.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!